What is a Renovation Loan?

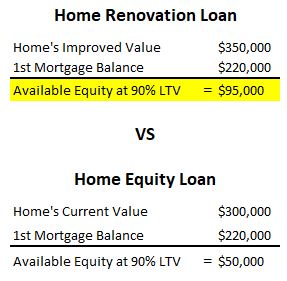

Our Renovation Loan is similar to a HELOC but allows you to borrow more. That's because we base your loan amount on the value of your home AFTER your projects are complete. This subtle difference can make a big difference on how much you qualify to borrow for your project.

How does the Process Work?

Once approved, your Home Renovation Loan acts as a line of credit that you are able to draw on for up to 9-months to complete your addition and/or renovations. We cap your interest rate upfront to protect you from the possibility of rising interest rates.

When your project is completed, your line of credit will be converted to a term loan. At this time, if your first mortgage is held by another lender, you will be able to refinance and combine it with your Home Renovation Loan at the same interest rate you previously locked in. As a result, you will make just one monthly mortgage payment to Adventure Credit Union.

Contact Us

Apply Online