Accessing Your Mortgage Account

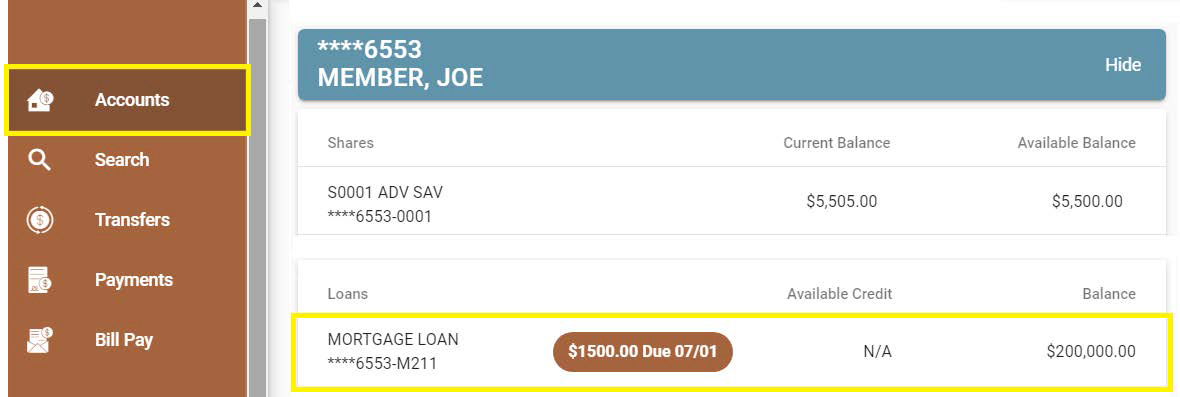

You can access your mortgage account details by selecting the mortgage record under the Accounts tab of the main menu.

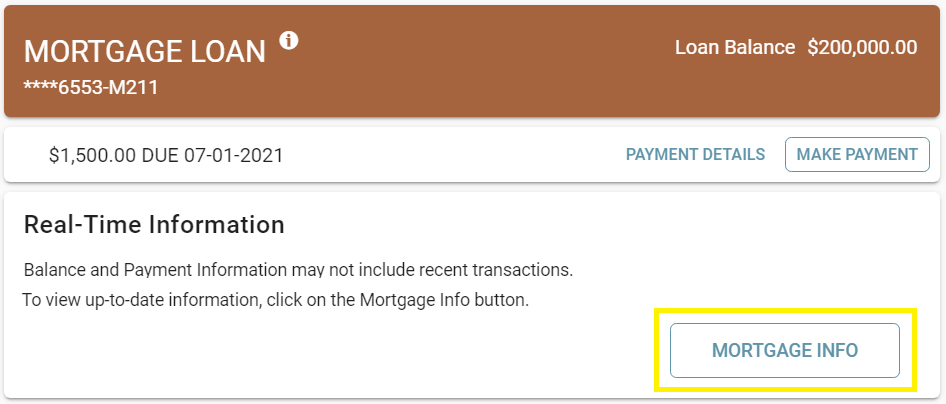

From the mortgage details page you can view standard payment information and make a payment from your Adventure account.

To access more detailed mortgage account information or set up a payment from an external financial institution, select MORTGAGE INFO.

*The Mortgage Info page opens in a new window. Pop-ups must be allowed in order to access it.

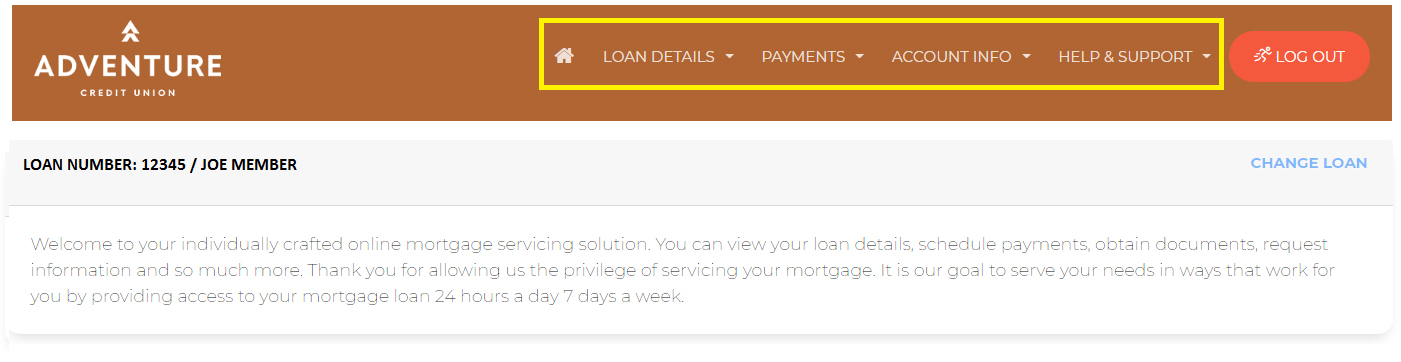

Mortgage Info

The Mortgage Info page has several menu options that allow you to access a wide range of services and account details for your mortgage account.

Payments Tab

- Payment History

The Payment History tab provides an overview of the payments made on your mortgage account. You can view the breakdown of a specific payment by selecting VIEW. You can also search for previous payments using the search feature.

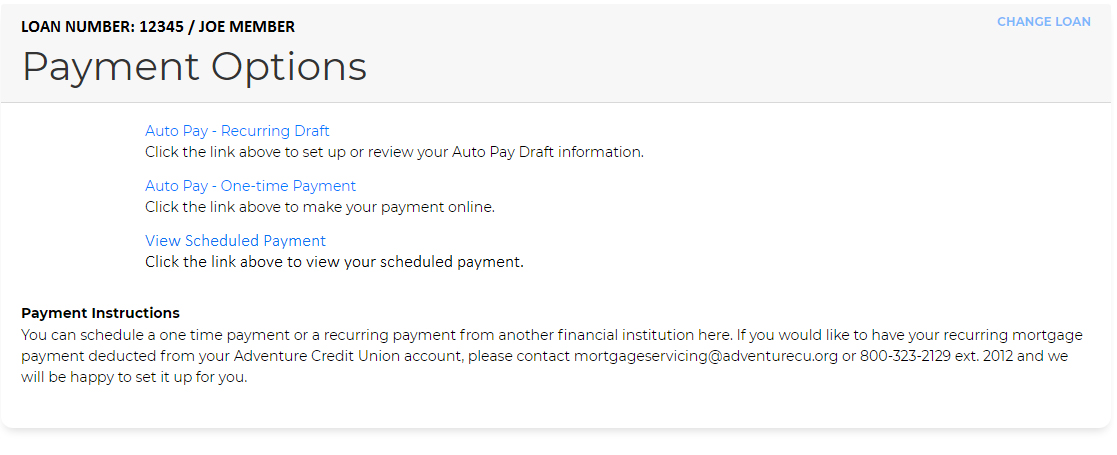

- Payment Options

The Payments Options tab allows you to set up and manage your one-time or recurring payments from an external financial institution.